We believe that vaccine prospects are likely to make 2021 a year of global economic recovery. While markets have already priced in much of a return to normality, the ongoing fiscal and monetary stimulus appear to have the means to power a corporate profits rebound until further into the year, particularly whilst central banks remain supportive of equity markets. Short term, we would not rule out a ‘pause that refreshes’.

ASSET ALLOCATION HIGHLIGHTS:

• Rotation towards Value: Once a vaccine is widely available and lockdowns have been eased, we believe that normal early-cycle recovery dynamics should resume, with a rotation toward relatively cheaper value and non-U.S. stocks that are likely to benefit from a return to more normal economic activity

• Deficit Spending: The price of the pandemic in monetary terms has undoubtedly been a huge increase in government debt. However, whilst it may be premature to anticipate the possibility that governments will start to trim deficits through tax hikes and lower spending, it may be a consideration in the second half of the year.

• Global Growth Forecast: In the U.S., we believe that the post-vaccine recovery period will lead to real GDP growth in excess of 5% in 2021. Bond markets are already reflecting improved growth prospects, if not specifically growing inflationary prospects.

• European Outperformance: We believe Europe’s exposure to financials and cyclically sensitive sectors gives it potential to outperform in the post-vaccine phase of the recovery, when economic activity picks up and as yield curves steepen.

• Yield Curve Control: Major central banks have made it clear that they will wait until after inflation rises before raising rates. We think a slow-acting Fed should limit the rise in the 10-year U.S. Treasury yield to between 1.1% to 1.4%-compared to its current level of 0.85% in early December.

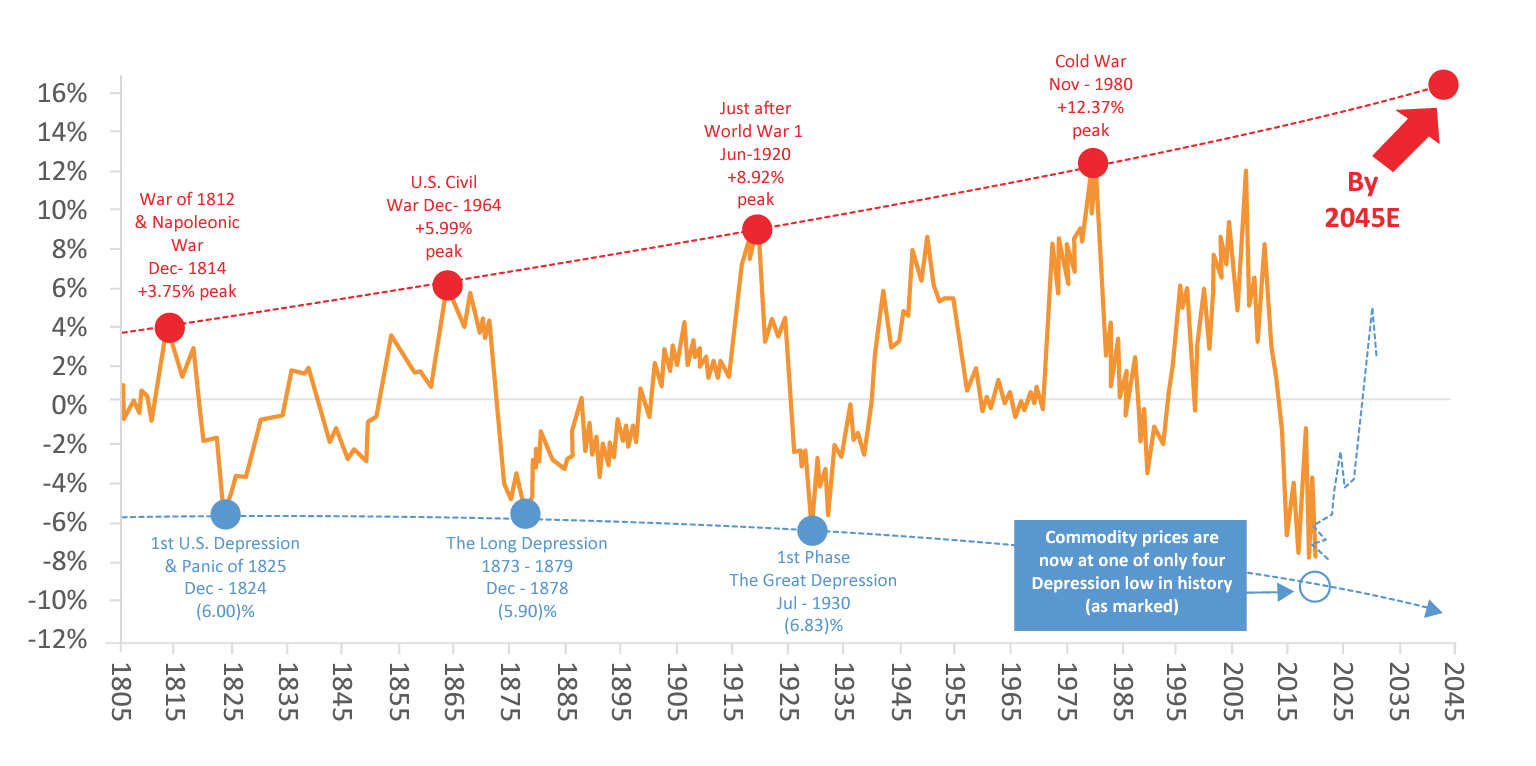

• The commodity bull: In the past 227 years of recorded market prices, the world has witnessed a mere six commodity bull markets. We’ve just begun the next.

KEY MARKET THEMES

With the world in the early post-recession recovery phase of the business cycle, our medium term outlook for economies and corporate earnings is positive. We believe that 2021 will feature an extended period of rising inflation, contained interest rate growth that favours equities over bonds, certainly in the first half of the year. In the short-term, investor sentiment is a risk and a ‘gut check’ in financial markets is likely in the coming weeks. However, that would provide a good buying opportunity into the summer.

Markets have adopted a very optimistic stance towards the vaccine, its efficacy and the success of its distribution. Any sustained logistical difficulties in distributing the vaccine and negative economic growth in early 2021, could be a reason for a shorter term pause. However, unless government support measures are unwound before investors’ expectations for them to do, we see markets generally tracking higher until the mid year at least.

Geopolitics could also deliver negative surprises from China, Iran or Russia as the new administration of President-elect Joe Biden takes power in the U.S. From a valuation perspective, certain US markets are very highly valued, although there are better pockets of value in emerging markets. Sentiment is frothy, yet the monetary and fiscal cycle remains supportive.

This leaves us slightly cautious on the near-term outlook, but more positive for the medium-term, with expensive valuations offset by the wall of fiscal stimulus governments have promised. During any correction in the first quarter, whilst the vaccine progress is proceeding in line with expectations, we believe that dislocated sectors (e.g., restaurants, travel and hotels) have the most outperformance potential, along with a continued bid for anything commodity or renewables focussed. Our working thesis is that the ‘pent up’ demand for planes, trains and automobiles is greater than currently priced in. Meanwhile, the Federal Reserve in the United States continues to maintain an ultra-accommodative policy stance. In a word where every central bank has adopted very ‘easy money’ policies, the US is the easiest. Even with our expectation for a robust 2021, the Fed’s focus on generating an inflation overshoot should leave plenty of runway for the expansion to strengthen and broaden. The three biggest challenges we see for markets are the concentration risk in major U.S. equity benchmarks – which have a composition skewed toward the stay-at-home mega cap technology stocks, moderately expensive valuations in equity and credit and an increasingly optimistic fund manager consensus.

EUROPE AND THE UK TO BENEFIT FROM A WELL ESTABLISHED CHINESE RECOVERY

In Europe, the second wave of virus infections had reversed the third-quarter V-shaped recovery, with the region on track to record negative GDP (gross domestic product) growth in the fourth quarter. Localised lockdowns seem to have been effective thought, with infections rates falling at a prodigious rate. We believe European stocks have much potential for outperformance.

The region is also more exposed to global trade than the U.S., and should be a beneficiary of a recovery in Chinese demand. In short, after five years of underperformance, we believe Europe will finally outperform the US. COVID-19 and Brexit uncertainty had led the UK as a serial underperformer for years, with the FTSE 100 Index the worst performing regional equity market (by a wide margin) in 2020. However, we believe it could be one of the better performers in 2021. The UK market is cheap relative to other markets and is overweight the financials, materials and cyclical sectors that should benefit the most from a global recovery. The Chinese economy has returned to almost pre-pandemic output levels, which is a significant achievement, given the depth of its first-quarter downturn.

DOWN UNDER ON TOP

We believe that Japan’s rebound from the pandemic is likely to lag other developed economies, despite its less severe COVID-19 outbreak. This reflects the structural weaknesses that were in place before the pandemic, such as subdued consumption from its aging population. However, its stock market could continue to lead as the Nikkei 225 often does when there is a cyclical improvement in global growth. We are most constructive on anything commodity related, and Australia which has controlled the virus outbreak better than most other countries and, with a relatively open economy, is likely to see an expansion of the Reserve Bank of Australia’s quantitative easing program. Similarly in Canada, we believe that the country’s exposure to commodities – particularly oil – will benefit from a rebound in the global economy. While business investment may be slower to materialise, both the housing market and improving commodity prices will likely serve as foundations to an economic recovery. Almost every indicator we review shows higher reported inflation coming through….

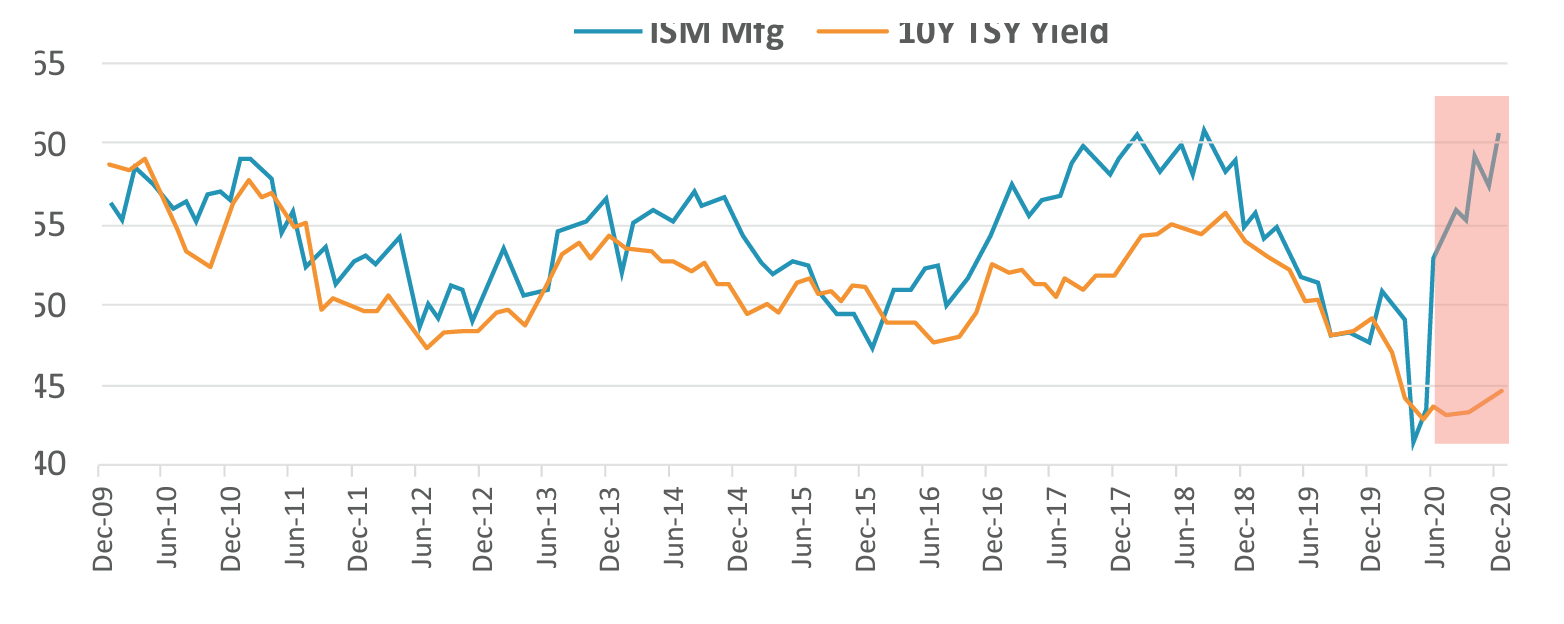

CHART 1: US MANUFACTURING NUMBERS SUGGESTING HIGHER INTEREST YIELDS TO FOLLOW.

Source: Bloomberg, Hedgeye, ARIA

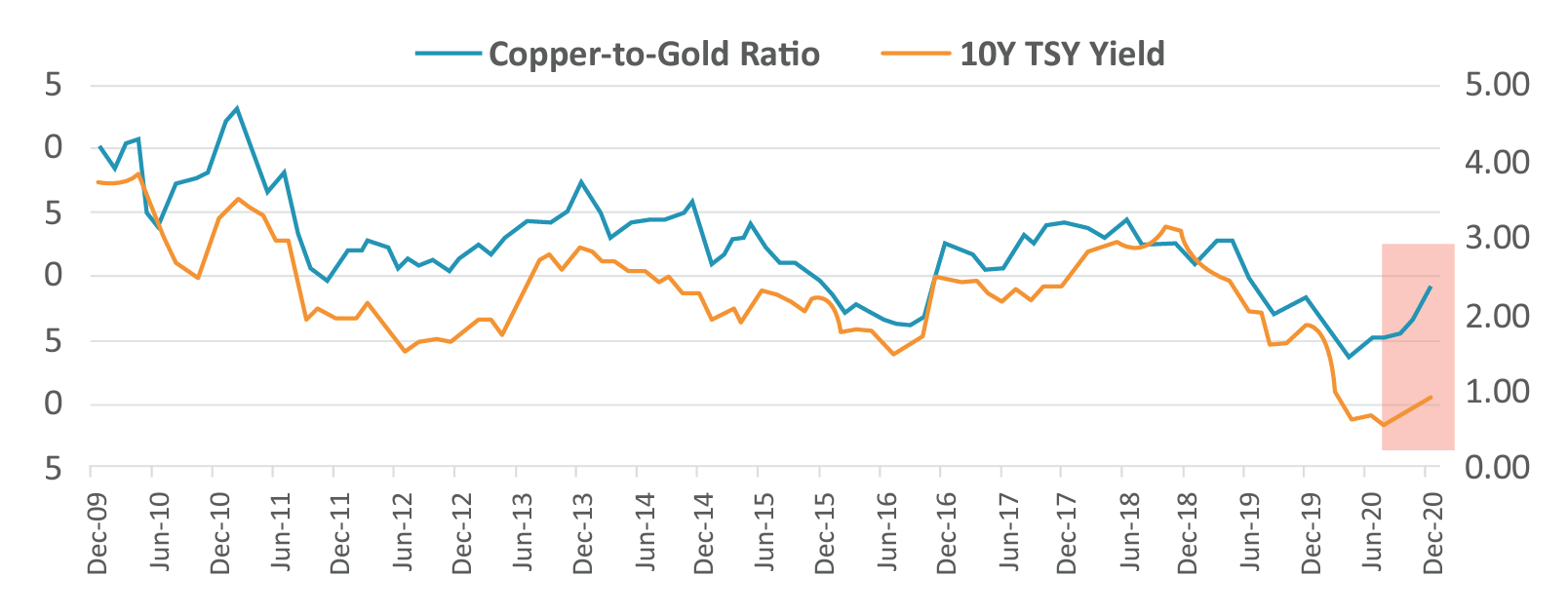

CHART 2: COPPER OUTPERFORMING GOLD TYPICALLY LEADS HIGHER INTEREST RATES

Source: Bloomberg, Hedgeye, ARIA

ASSET CLASS VIEWS

Equities

• We have a preference for non-U.S. equities.

• The post-vaccine economic recovery should favour undervalued cyclical value stocks over expensive technology and growth stocks – as they perform better as interest rates rise to reflect a recovering environment.

• In particular, we like the value in emerging markets (EM) equities.

• China’s early exit from the lockdown and stimulus measures will likely benefit EM more broadly, as should the recovery in global demand and a weaker U.S. dollar, not to mention their outperformance tends to coincide with that of the commodity sector.

Fixed income:

• We see government bonds as universally expensive.

• Low inflation and dovish central banks should limit the rise in bond yields during the recovery certainly at the short end.

• U.S. inflation-linked bonds offer good value with break-even inflation rates well below the Fed’s targeted rate of inflation.

• However, any inflation metric that we consider currently suggests longer term interest rates will grind higher without central bank intervention.

• We view high-yield and investment-grade credit as slightly expensive on a spread basis, but believe they have an attractive post-vaccine cycle outlook.

Currencies

• The U.S. dollar should weaken amid the global economic recovery, given its counter-cyclical behaviour.

• In fact the Federal Reserve’s policy is to structurally create a weaker US Dollar.

• For the time being that is very much the consensus, so during Q1 we should expect the potential for a shorter term recovery in the greenback.

• The main beneficiaries should be the economically sensitive commodity currencies – the Australian dollar, the New Zealand dollar and the Canadian dollar.

• We believe British sterling is undervalued, as there is so much bad news around Brexit priced in, only a few things need to do well for it to state a significant recovery.

CONCLUDING THOUGHTS: RIDING THE COMMODITY BULL:

TA commodity bull market is part and parcel of the new secular inflationary regime, which we believe government and monetary policy has set the stage for. Importantly, a new inflation will leave many investors unprepared for its resurgence. We think this theme will rapidly come to dominate investors’ attention in 2021, and could last for a decade or more.

CHART 3: THE SCENE IS SET FOR A MULTI YEAR COMMODITY BULL MARKET

Source: Steifel Report

In the past 227 years of recorded market prices, the world has witnessed a mere six commodity bull markets. We believe we are at the beginning of the seventh. Central bank policy with every cycle since Alan Greenspan’s rescue of market troubles caused by the Long Term Capital Markets crash in 1998 has been a combination of easing of financial conditions, meaning lower interest rates and quantitative easing style measures, along with bailouts. However, the size of stimulus applied in this particular crisis dwarfs the responses from previous cycles. Any inflation indicator we currently look at gives the same message. In recent weeks, Gold has underperformed but we ultimately expect to see 2200 USD per ounce during the year, although this will potential seem to have ‘underperformed’ compared to other industrial more cyclical commodities such as silver and crude oil. Portfolios are positioned in sectors which should benefit from the potential of inflation to surprise on the upside.