In Gold we Trust

Currency Climate Change and Gold as a future international reserve asset Bullion, for the reasons ...

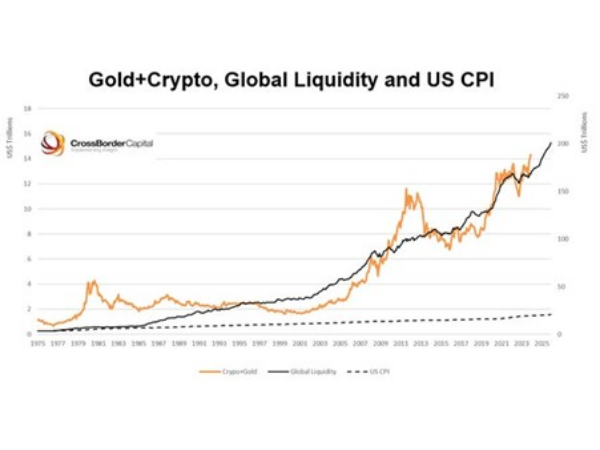

Investment is cyclical—sometimes favouring defensive assets, other times pro-cyclical ones, cash, or precious metals. While many managers rely on valuations to navigate market volatility, they may overlook a more fundamental driver of asset prices: liquidity.

We use a particular lens to view the world – one which draws heavily upon the liquidity available in the financial system, as we feel it is an oft overlooked but pivotal driver of the business cycle – and by extension, the prospects for asset class prices too.

Financial shocks which lead to falls in equity and bond prices, may not be driven by a global economic slowdown, just in the way that gains in equity markets in recent years may not have been justified by earnings growth or improvements in the real economy. In fact ,they may well be better explained by changes in liquidity conditions.

By mapping liquidity and financial conditions, we seek to identify which ‘regime’ the investing landscape best describes.

Regime based investing means tracking financial conditions including the rate of change of inflation and credit to determine which stage of the cycle we are in – Goldilocks, reflation, inflation and deflation.

We simply our asset allocation approach into four quadrants – a macro economic compass.

The Era of Hard Assets Begins

It’s tracking the global liquidity cycle that causes us to lean so heavily towards ‘asset scarcity’ or those with positive correlation to inflation.

Growth in liquidity and high debt burdens or fiscal deficits, tend to lead to inflationary outcomes, in which hard assets, of those of limited supply, outperform.

| Regime | Overweight | Underweight |

|---|---|---|

| Goldilocks | Fixed Income, Growth over Vlaue and corporate credit | Emerging Market equities, commodities and cyclical sectors; |

| Inflation | Energy equities, cyclical sectors, gold and corporate credit | Volatility protection, hedges and cash |

| Reflation | Emerging market equities, banks and industrial commodities | Government bonds, corporate credit and growth / technology stocks |

| Deflation | Government bonds, USD Dollars and Volatility Protection | Equities, corporate bonds, emerging markets and commodities |

| Metric | Response |

|---|---|

| Realised Correlation Changes | Consider asset mix to include currencies, commodities and hedges to mitigate scenario whereby bonds no longer provide a stock market hedge. |

| Higher realised volatility | Often before markets fall, they will experience a higher level of volatility. During such times, we increase our volatility control overlay strategies, by considering hedges, protection, reducing net market exposure and moving into more defensive investments. |

| Higher realised volatility in ARIA Funds | Systematically increase cash to keep portfolios within targeted volatlity mandates. |

As the volatility regime changes, our investing tactics follow

Concerns surrrounding the persistence of inflation, and the need for Central banks to respond, will continue to drive volatility in asset markets. After years of rising liquidity, to address growing inflationary pressures, monetary policy makers are being forced to reduce the availability of global liquidity and tighten financial conditions. Historically, that has led to tough trading conditions for markets, and sustained volatility in equity markets. Our range of funds, which employ our propreitary ‘Dynamic Volatility Control’ techniques should be well placed to mitigate more challenging conditions.

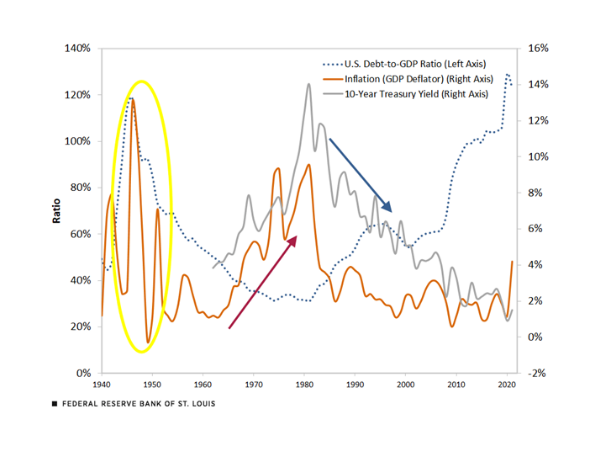

It is noteworthy how recently gold and other metals have performed well, even during broad-based stock market selloffs. This has happened in past periods characterised by extreme debt imbalances were the path of least resistance toward deleveraging typically involves lowering interest rates while allowing inflation to run above trend — whether through natural market forces or deliberate policy intervention.

A sustained decline in the US dollar, in our view, could carry significant implications for global financial markets. Historically, there has been a clear inverse relationship between the dollar’s long-term trajectory and the commodities-to-equities ratio. When the dollar enters a structural downtrend, empirical evidence shows that commodities and other hard assets tend to outperform US equities by a wide margin.

Such conditions tend to create a highly favourable environment for hard assets. In our view, this dynamic is still in its early stages.

Currency Climate Change and Gold as a future international reserve asset Bullion, for the reasons ...

Never has so much financial muscle, nor religion of all stripes, or polities of all ...

Considering the Alternatives: Navigator Approach to Portfolio Management How best to protect and grow wealth? ...