Alphapredictor® uses advanced machine learning to identify investment trends, anticipate market shifts, and help you stay ahead of the curve—across asset classes and business cycles.

Alphapredictor® is a forward-looking macroeconomic and asset allocation forecasting tool.

It helps investors identify the right assets at the right time by analyzing market signals and economic cycles.

Provides deep insights into the key drivers of investment asset and fund behaviour, along with important macro sensitivities which may impact

performance.

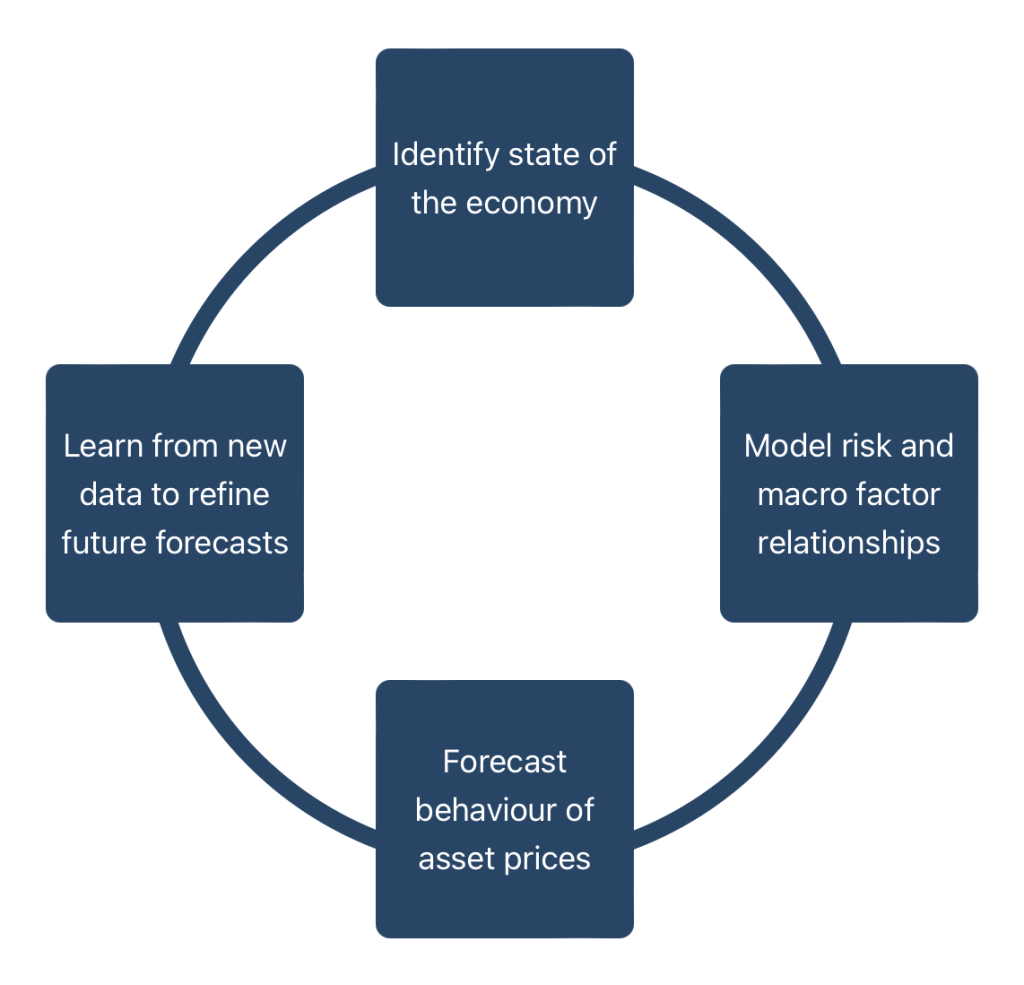

Our model focuses on the right data not just ‘big’ data. Macroeconomic variables to identify changing economic conditions and risk factors to help determine what is driving risk and returns.

Our model learns about the evolving relationships between macroeconomic variables, risk factors and asset prices to calculate probabilities and make predictions about the future.

Our powerful and flexible portfolio engine can be used to build portfolios that aim to outperform benchmarks, achieve specific objectives and/or reflect ‘house’ views.

Macroeconomic variables are used to identify the state of the economy

– Default spread

– Term spread

– Inflation

– Interest Rate

– Dividend yield

– Sentiment

Risk factors are used to identify risk exposures and the return drivers of investment assets

– Equity beta

– Fixed Income beta

– Credit beta

– Commodity beta

– Property beta

AlphaPredictor® is a cutting-edge investment technology at the frontier of quantitative investing and based on the academic research of our founders. AlphaPredictor® has the ability to model complex interactions between macro variables, risk factors and security prices, learning and adapting, quickly responding to fast-changing conditions.

The technology has a range of applications from generating forecasts, creating portfolios, understanding fund and security behaviour, generating forward-looking fund ratings and providing detailed attribution and risk reporting.

Forecasts the behaviour of funds, asset classes, markets, factors, sectors and securities over different time horizons

An adaptive model that captures the complex and evolving relationships between macro variables, risk factors and security prices

Discover how AlphaPredictor® applies advanced forecasting to reshape asset allocation strategies and multi-asset investing.

From data-driven insights to market adaptability, AlphaPredictor® helps navigate today’s evolving investment landscape.

Multi-asset strategies continue to dominate investor flows, offering a ‘plug and play’ solution for diversification.

AlphaPredictor® provides targeted risk insights to optimize these strategies.

In a world where constant change is the norm, traditional allocation models require a refresh.

AlphaPredictor® supports dynamic reassessment to keep portfolios aligned with shifting market conditions.