TARIFF TALK TEMPERED

The markets have regained their composure, and then some, having digested the pyrotechnics witnessed in early April. Becoming increasingly resilient to ‘tariff talk’, investors for the moment appear to be taking the US President’s pronouncements in their stride, as few of the threats seem to ultimately ‘bite’.

However, there are other factors supporting the significant ramp in equities, bonds and risk assets generally. In particular, the liquidity backdrop, which when measured as a broad measure of the U.S. money supply, rose by 4.5% year-over-year to reach a new record high.

Liquidity is a measure of the ‘availability of credit’, almost how much oil is in the economic engine and something we pay very close attention to. It can be a significant tailwind for asset prices to move higher and it may remain a supporting pillar of stock markets for some time to come.

THE YEAR OF THE ‘W’

Having anticipated the early year correction, we have been able to profit from the rally. Whilst the most major equity indices move to new highs, there is still scepticism of the move, as many investors have been left behind given the speed of the advance since the April lows.

It has principally been led by ‘large cap US growth’ or technology stocks again, and in order to continue to gain ground, the ‘average’ share also needs to participate and move higher. However, we anticipate (post a late summer set back), that will be the case. Our Quad Engine, the weathervane which seeks to identify which of the four economic seasons we currently reside in, has signalled a move to the ‘reflationary quad’. This is still a ‘risk on’ environment, meaning there may be further gains ultimately to be had in markets, but just from different pockets of it relative to those which have prospered more recently. More specifically, we would expect to see areas such as emerging markets, mining and commodity stocks potentially begin to lead the way from here.

The table below shows how equity market sector exposure varies between the four quads:

| Quad 1: Goldilocks | Quad 2: Reflation | Quad 3: Stagflation | Quad 4: Decline |

| Growth Rising, inflation falling | Growth rising, inflation rising | Growth falling, inflation rising | Growth falling, inflation falling |

| Information Technology | Basic materials | Commodity related sectors | Utilities |

| Consumer Discretionary | Emerging Markets | Real Estate Investment Trusts | Healthcare |

| Semiconductors | Commodity related sectors | Infrastructure | Consumer Staples |

We track dozens of macro-economic variables daily, to measure whether inflation is rising or falling, as well as to have a handle on the future direction of credit – be it up or down. A combination of those four outcomes, as set out in the table above, determines which of the quad regimes describes best the global economy at that point in time.

FROTHY COFFEE

However, there are emerging signs of speculative excess in this current move, which could cause a shorter term pause. The appetite for more speculative stocks appears to be on the rise, and often a spike in ‘risk appetite’ – either way, be it fear or greed, may precede a reverse in the market’s primary direction. In our current scenario, trading volumes in unprofitable stocks, penny stocks or companies with extremely high valuations are beginning to resemble the conditions we had during 2020 lockdown.

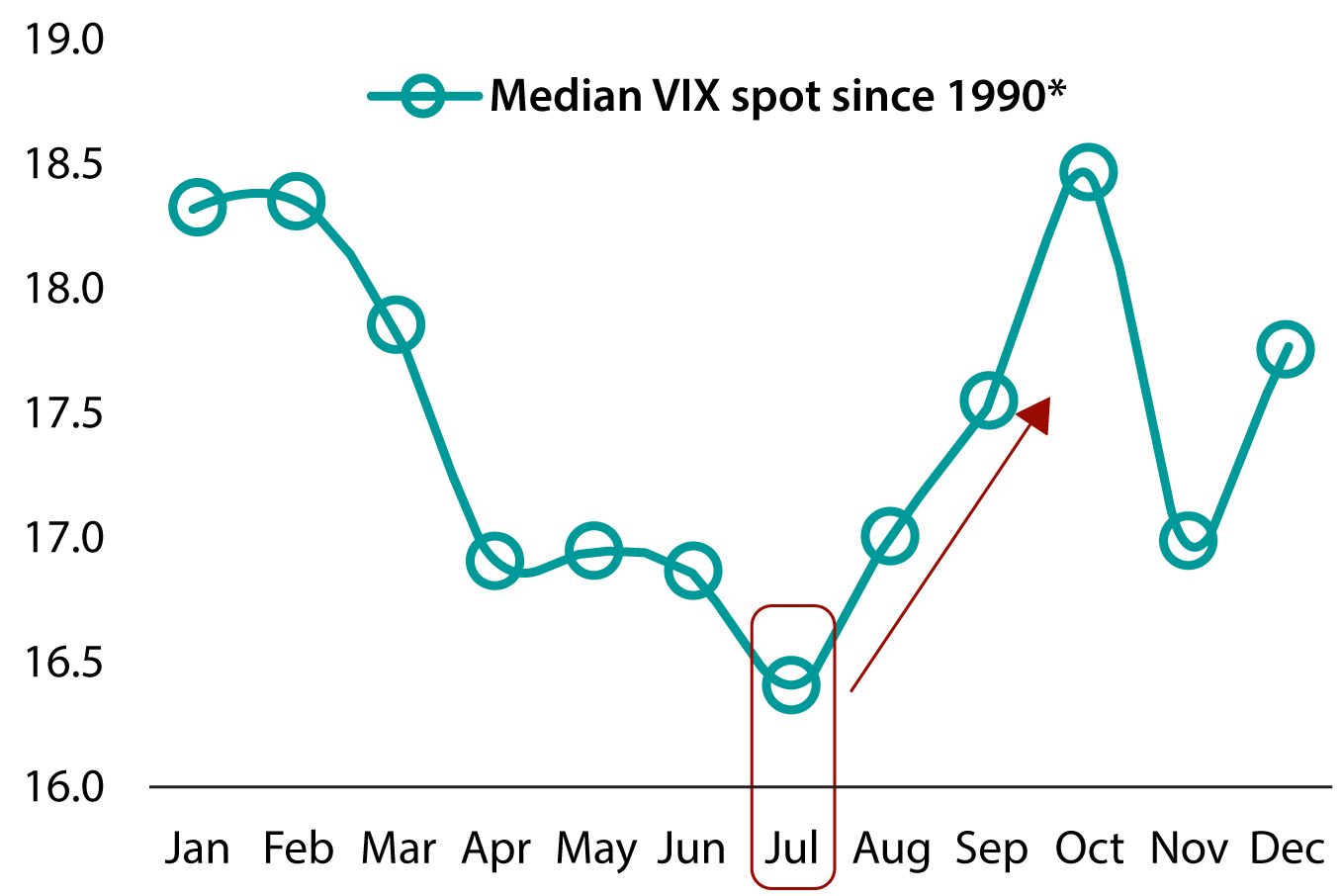

Moreover, this has all suppressed volatility ( which refers to how steadily the stock market travels without a setback), to historically low levels, just at a point in the calendar when it tends to witness a more volatile period.

Source: Bloomberg, ARIA

Copyright of Bloomberg Industry Group. As per the Copyright and Usage Guidelines of Bloomberg Industry Group, data reproduced under limited distribution restrictions and all recipients agree not to further distribute this document.

NEW QUAD REGIME: REFLATION

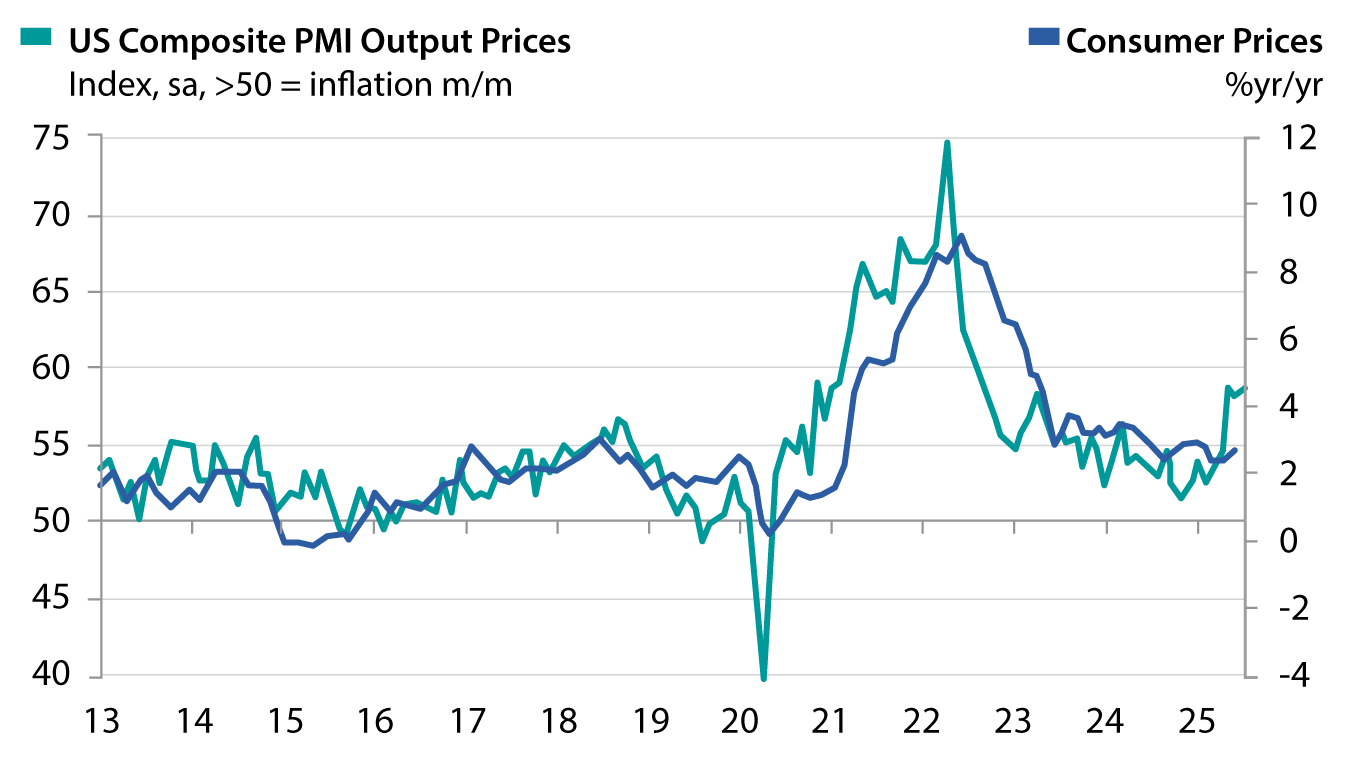

A high-profile visit from President Trump to the Federal Reserve, and some ‘face time’ with Jerome Powell, the Fed’s President, all sought to put pressure on the US central banking authority to lower rates. Whilst rate cuts are not expected at the July meeting, we find it very difficult to make the case for further easing over the balance of the year either. With the liquidity taps already flowing, and the residual government spend from the Biden infrastructure programs, the US economy has not cracked, displaying remarkable resilience in employment numbers. Furthermore, increasingly visible signs that inflation has bottomed may also constrain the Fed’s hand. The below chart shows evidence of tariffs impacting consumer prices (CPI). This inflation measure is composed of different components, one of them being prices paid in business surveys, and the chart shows historically how a major pick up in output prices has tended to lead consumer prices (the blue line leading the orange one).

Source: S&P Global PMI, Bureau of Labour Statistics, ARIA.

CONCLUSION:

We had suggested this year may be one that traces out a ‘W’ in shape. At this juncture, we are wary that the air in markets may be a bit thinner here, and reducing stock market exposure is a prudent course of action.

Easing trade tensions and significant liquidity tailwinds have pushed many markets to new highs. There’s also hope in some quarters, that President Trump may yet travel to China to engage in a negotiation with one of its biggest trading partners. For now though, we believe a truce has been called. China cannot really advance its military ambitions without access to semiconductor chips largely controlled by US firms, and the US’ own military industrial complex is heavily dependent on rare earth minerals, that China exerts significant control over the processing of.

In light of the above, Navigator portfolios have taken the following action:

- Sold Information Technology equity exposure (circa 9-11%)

- Sold Consumer Discretionary equity exposure (circa 9-11%)

- Bought Volatility ETF insurance protection (between 3-5)%

All of these measures are essentially to reduce the stock market exposure of the portfolio, awaiting lower prices to cycle into those sectors which perform best against a more reflationary backdrop – those which can protect margins, and pass on higher input costs and inflationary pressures pick up once more.