Recycling Roads

Recycling Roads Article Paving the Way to Tomorrow: The Evolution of Renewable Asphalt for Sustainable ...

Navigate funds is an independent asset management platform, that provides investors of all stripes access to institutional quality real asset investing. We build diversified, resilient portfolios and develop and manage substantial commodity, infrastructure and low carbon sustainable supply chains and assets.

Focussed on delivering investment solutions that are ‘all cycle’ – those that

weather the financial season; be that inflationary, deflationary or other.

We’re ‘all in’ on seeking to surgically identify specific investing strategies

and risk premiums, be those in listed public securities or ‘physical’ real

assets; and be the bridge that simplifies our client’s attainment of those

harder to achieve yet rewarding objectives.

Market and economic variables shift over time meaning that different market regimes require different approaches. Long periods have shown both under- and out-performance on the part of both active and passive approaches.

The key to enduring outperformance is flexibility – being dynamic, recognising that different regimes require different tactics.

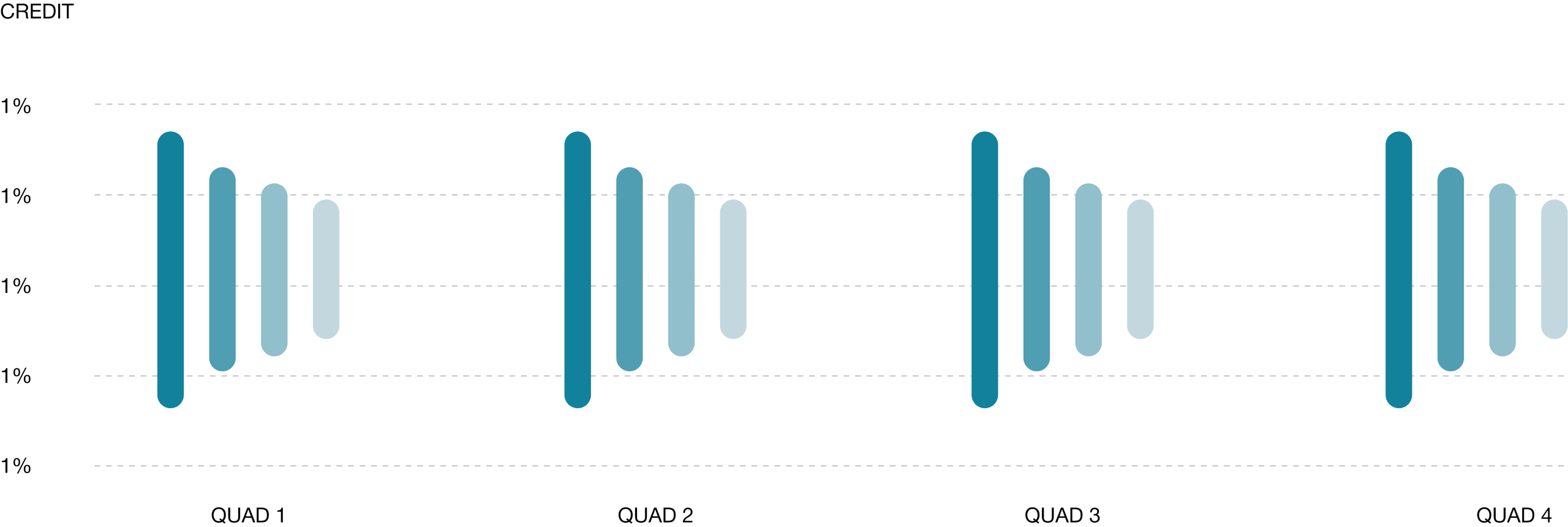

However, we believe that responsible management is one that seeks to control volatility – whatever the weather. Moreover, we’ve developed, and continue to work to a concept know as ‘QuadLogic’. We believe the most of recorded financial history can be distilled into one of four quads, each with distinct macro-economic characteristics. Different assets will behave differently in each quad, following return profiles that have been mapped over decades of data. We spend much of our time tracking macro economic variables to determine which quad best describes the current investing environment.

We offer funds and solutions that can perform throughout shifting economic regimes.

Renewables

Low Carbon Baseload

Bio-Fuels

ETN Programme

Equities

Commodities

Multi Asset

6.2%

Renewables

6.2%

Low Carbon Baseload

6.2%

Bio-Fuels

ETN Programme

6.2%

Equities

6.2%

Commodities

6.2%

Multi Asset

“You cannot beat the market, says the standard market doctrine.

Granted. But you can sidestep its worst punches.”

–Benoit Mandelbot, The (Mis)Behavior of Markets

Bringing together an approach where financial conditions drive the forward-looking returns of all asset classes, and the volatility of those returns, we implement an approach which seeks to mitigate volatility, smoothing out the return profile of our portfolios.

We believe two factors to be most consequential for forecasting future financial market returns: economic growth and inflation. We track both on a year-over-year rate of change basis to better understand the big picture then ask the fundamental question: Are growth and inflation heating up or cooling down? It is the second derivative aspect that is most important – it is not the change, but the rate of change. This aspect is pervasive across all asset prices.

Ultimately we’re defined by our people. But ultimately every organisation has to stand for certain ideals that all of its people rally around.

Never has so much financial muscle, nor religion of all stripes, or polities of all leanings been so aligned behind a single cause.

Read: In Gold We Trust

We have a breadth of proposition that can support individual private clients, financial advisers as well as institutions.

Whatever your investing goals, we provide a choice of investing styles to best match your investing personality.

As a technology provider, we have integrated both the tools and mapped them to investing solutions to support all your clients.

Supporting those during the most challenging of times.

Supporting educational establishments and charities to help broaden financial literacy and meet financial goals.

Institutional solutions including climate resilient and climate smart funds.

Financing infrastructure, and supporting food security initiatives.

Committed to providing a bridge for our clients to unlocking value from real asset value chains.

Managing Partner, Africa

Head of Capital Markets, EU

Head of Capital Markets

Quantitative Analyst

Managing Director, EU

Portfolio Manager

Investment Director

Investment Director

Investment Director

We’re firm in our commitment to effecting change, and ultimately raising the living standards of those who come into close contact with our projects.

We take our responsibility to steward capital as a global financial institution and ats ability to steward capital in such a way as to create inclusive futures for all – and lift livelihoods in doing so.

Recycling Roads Article Paving the Way to Tomorrow: The Evolution of Renewable Asphalt for Sustainable ...

The Dark Side of Solar Solar panels are symbols of the clean-energy revolution. Yet behind ...

Sunset Commodity: As Queensland bids farewell to its black-gold past, a surge of solar panels ...