Feeding the world is becoming harder as climate stress reshapes the supply of food and raw materials. This Article Fund invests in the owners and producers of vital soft commodities — wheat, sugar, cotton, soybeans, cattle, and farmland — whose pricing power strengthens when extreme weather disrupts supply. By harnessing the volatility created by a changing climate, the strategy seeks to turn global agricultural uncertainty into a source of resilient returns and income.

Gains exposure to climate volatility as a theme, and generates potentially positive returns from increasingly variable weather patterns.

A concentrated portfolio of well researched, high conviction ideas advised by highly credentialled sector specific team.

Portfolio Yield: Annualised distributions circa 5% plus.

Step 4

Step 5

Rob West is the CEO of Thunder Said Energy, an independent research consultancy uniquely focussed on the energy transition. Founded in 2019, Thunder Said Energy’s research examines different energy technologies, their economics, their technical challenges, and companies that can drive decarbonisation.

Thundersaid Energy provides deeply researched insights and opportunities, providing a rich universe of ideas for further investigation and potential inclusion in the ARIA Global Impact Income Fund. Prior Thunder Said Energy, Rob was the Head of Global Energy Research at Redburn.

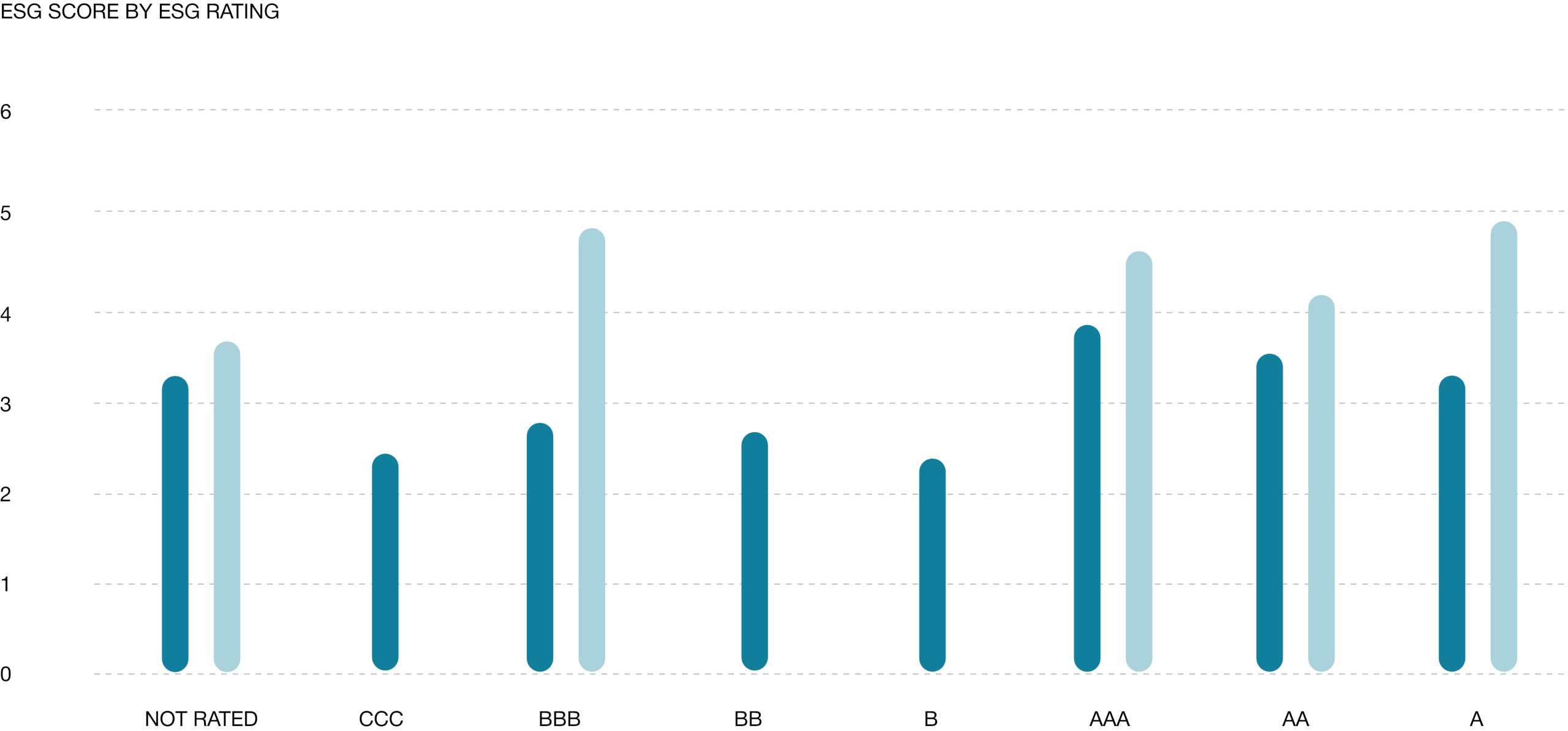

The chart shows the MSCI ESG Rating Distribution based on the fund’s and benchmark’s underlying holdings. Issuer MSCI ESG ratings are mapped directly to the numerical Bloomberg ESG Quality Score. The chart includes an ESG Rating distribution of all fund’s and benchmark’s holdings. Some asset types are out of scope for MSCI’s ESG analysis, e.g. Cash. They are removed from a fund’s or benchmark’s holdings prior to calculating both the ESG Coverage (%) and ESG analysis but are reflected above under ‘Not Rated’.

The sustainability scores of the fund and the benchmark are shown. The benchmark is the MSCI AC World (Net TR).

| Fund Name | Dividend Frequency | Distribution Yield | Announcement Date | Ex Date | Record Date | Payment Date |

|---|---|---|---|---|---|---|

| ARIA Global Impact Income Fund | Quarterly | 1.50% | 05/11/2021 | 05/11/2021 | 05/11/2021 | 05/11/2021 |

| ARIA Global Impact Income Fund | Quarterly | 0.89% | 28/01/2022 | 28/01/2022 | 28/01/2022 | 28/01/2022 |

| ARIA Global Impact Income Fund | Quarterly | 1.25% | 08/04/2022 | 08/04/2022 | 08/04/2022 | 08/04/2022 |

| ARIA Global Impact Income Fund | Quarterly | 1.50% | 01/07/2022 | 01/07/2022 | 01/07/2022 | 01/07/2022 |

| ARIA Global Impact Income Fund | Quarterly | 1.50% | 30/09/2022 | 30/09/2022 | 30/09/2022 | 30/09/2022 |

| ARIA Global Impact Income Fund | Quarterly | 1.50% | 31/12/2022 | 31/12/2022 | 31/12/2022 | 31/12/2022 |

| ARIA Global Impact Income Fund | Quarterly | 1.50% | 31/03/2023 | 31/03/2023 | 31/03/2023 | 31/03/2023 |

Fund Name

Share Class

ISIN

Currency

AMC

Minimum Investment

ARIA Global Impact Income Fund

A10

MT7000026373

GBP

0.65%

£ 2,000,000.00

ARIA Global Impact Income Fund

A10

MT7000026324

EUR

0.65%

€ 2,000,000.00

ARIA Global Impact Income Fund

A10

MT7000026274

USD

0.65%

$ 2,000,000.00

ARIA Global Impact Income Fund

C10

MT7000026399

GBP

0.95%

£ 10,000.00

ARIA Global Impact Income Fund

C10

MT7000026340

EUR

0.95%

€ 10,000.00

ARIA Global Impact Income Fund

C10

MT7000026290

USD

0.95%

$ 10,000.00

ARIA Global Impact Income Fund

E10

MT7000026407

GPB

1.50%

£ 10,000.00

ARIA Global Impact Income Fund

E10

MT7000026357

EUR

1.50%

€ 10,000.00

ARIA Global Impact Income Fund

E10

MT7000026308

USD

1.50%

$ 10,000.00

ARIA Global Impact Income Fund

D10

MT7000026415

GBP

0.95%

£ 250,000.00

ARIA Global Impact Income Fund

D10

MT7000026415

GBP

0.95%

£ 250,000.00

ARIA Global Impact Income Fund

D10

MT7000026415

GBP

0.95%

£ 250,000.00

ARIA Global Impact Income Fund

D10

MT7000026365

EUR

0.95%

€ 250,000.00