Designed for investors who value simplicity, and happy to accept market returns with limited intervention.

Equilibrium offers a low-cost, globally diversified investment solution. Using third-party ETFs, it passively tracks global financial markets across a broad mix of asset classes—aiming to capture market growth without the costs of active management.

At the core of Equilibrium are two beliefs:

– Markets grow over the long term.

– Active management rarely beats the market consistently.

By sticking to these principles, Equilibrium provides an efficient, low-cost way to participate in market growth. The portfolio is rebalanced annually to stay aligned with its target allocation, regardless of market ups or downs.

You prefer a passive approach over chasing market-timing or stock-picking wins.

You’re comfortable with global market ups and downs, knowing long-term growth matters most.

You want a low-cost, diversified portfolio that stays on track without constant adjustments.

| Investing Style | Traditional |

|---|---|

| Allocation Type | Equity & Bond |

| Apporach | Passive |

| No. of Risk Profiles | 5 |

| Risk Profile Calibration | Dynamic Planner; Finametrica |

| Holdings Universe | UCITS V funds |

| Currencies Available | EUR/GBP/USD |

| Minimum Investment | 50000 |

| Annual Managament Charge | 0.24% |

| Ongoing Charge Figure | 0.54% |

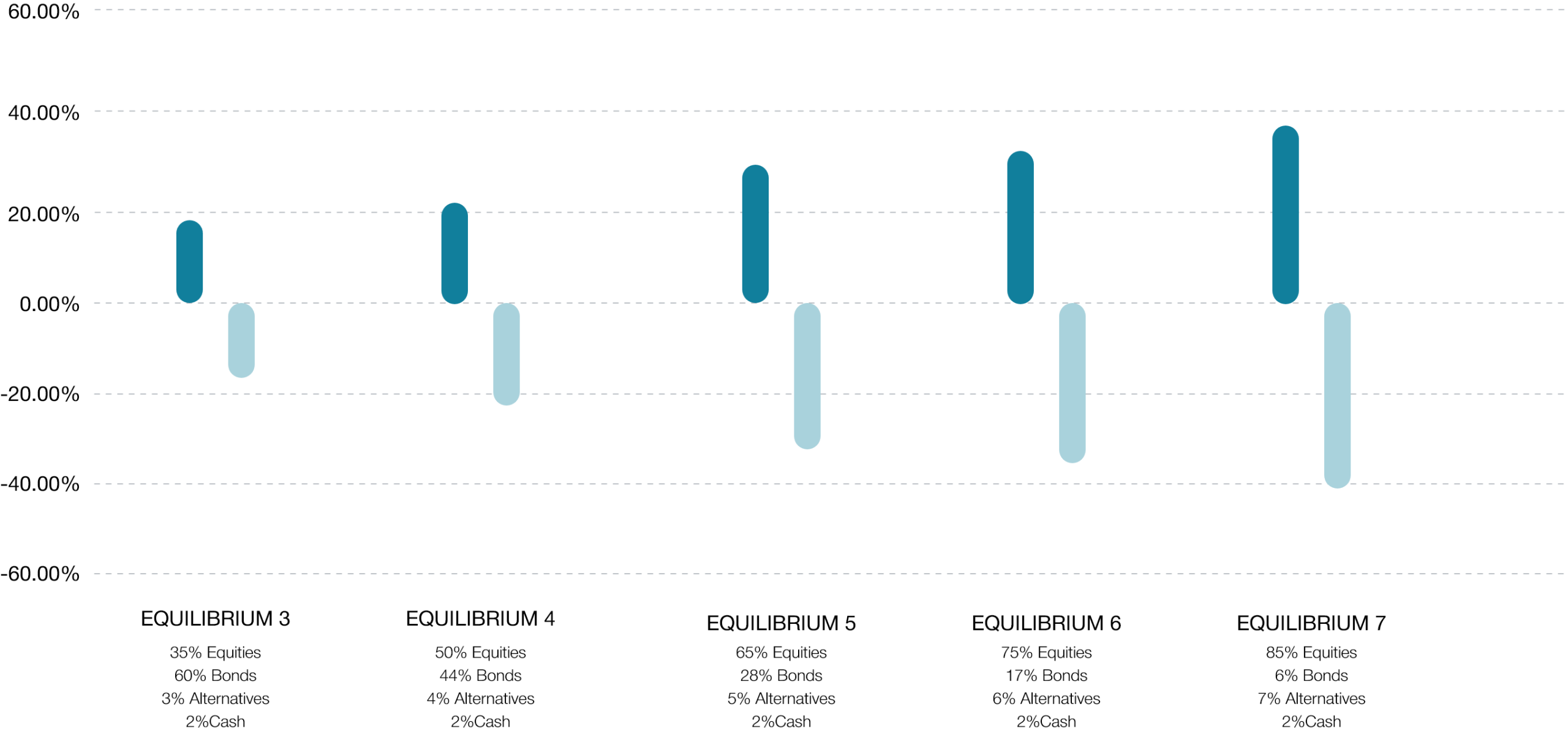

Over the past 10 years, equity-heavy portfolios have delivered higher returns—but also higher volatility.

Equilibrium lets you choose your comfort zone with 5 risk levels, each designed to track market performance in line with your goals.

Our approach removes the guesswork while giving you clarity on potential ups and downs, before fees.

Equilibirum’s portfolio allocation is matched to the global market cap weights for each asset class within its universe.

The portfolio ebbs and flows with the global market waiting for markets to rise over the long-term. ‘Buy and Hold’ investing believes that it is time in the market that drives performance rather than market timing.

By using low-cost tracker ETFs to minimize the fee drag on the porfolio, Equilibrium looks to move in line with the markets, as they go up and down.

As price fluctuations drift the asset allocation too far away from its desired market allocation, it is rebalanced back to the market allocation. Typically annually to reduce trading costs drag.

Allows investors to track the market minimizing the chance of underperformance.

Allows investors to track the market minimizing the chance of underperformance.

Allows investors to track the market minimizing the chance of underperformance.

Offer investors a risk/rated globally diversified portfolio.

help to keep fee drag/costs to a minimium to maximise>long term total returns.

Equilibrium offers 5 levels of risk asset exposure to suit every passive investors needs. The strategies are not designed to outperform the market performance but simply replicate it as close as possible through low cost ETFs. The strategies operate within a multi-asset universe to offer investors the benefits of diversification.