AI stocks have received something of a bloody nose, as the Chinese upstart DeepSeek has led investors to question whether the US hyperscalers’ plans to invest 270bn USD this year into AI alone, is money well spent. Having already received the thumbs up from legendary VC and tech investor Marc Andreessen, of the eponymous Andreessen Horowitz, vaunted for being early investors into Facebook, AirBnB, Stripe and Pinterest, this is a sputnik type moment for the denizens of Silicon Valley.

Just three weeks ago, (see Superficially Sentient and the Magnificent Bribe here), we had raised concerns about the lack of economic moat that many of these AI firms seemed to hold. Essentially LLM’s have become a commoditised proposition with the same data, training sets and even responses to a given prompt. Whilst wonderful productivity tools, there is currently little to distinguish them. Despite the Biden Administrations’ export controls to limit the availability of the very latest semiconductor chips to foreign powers, China’s DeepSeek has managed to build a very passable AI engine for a fraction of the cost and capital deployed by the likes of Microsoft, OpenAI and Google. At this juncture, it is unlikely that Chinese competition is able to offer the same protocol and governance protocols that Nvidia and Broadcom chips do, but make no mistake, this is a significant shot across the semiconductor sectors’ bows. The cost advantage demonstrated by Chinese AI is a blaring klaxon call, in that it would be naïve to continue to believe that Beijing is yet to leave the shadows of supercomputing stone age, that open source technologies do not underpin Schumpeterian creative destruction and that monopoly profits of the Nasdaq’s Mag-7 are a given.

However, in some respects, this development should also give investors reason to cheer. Jevons Paradox explains how when something become more efficient, more of it is deployed rather than less. For AI to become ubiquitous, and useful to consumers and thus drive widespread societal productivity gains, it needs to be cheaper. DeepSeek through its efficiency gains, even reprogramming some older chips to squeeze every last drop of computing power from them, has been clocked at 1mn USD per million tokens, rather than Anthropic’s 15mnUSD per million tokens. Producer’s rents lost, are consumers’ gains.

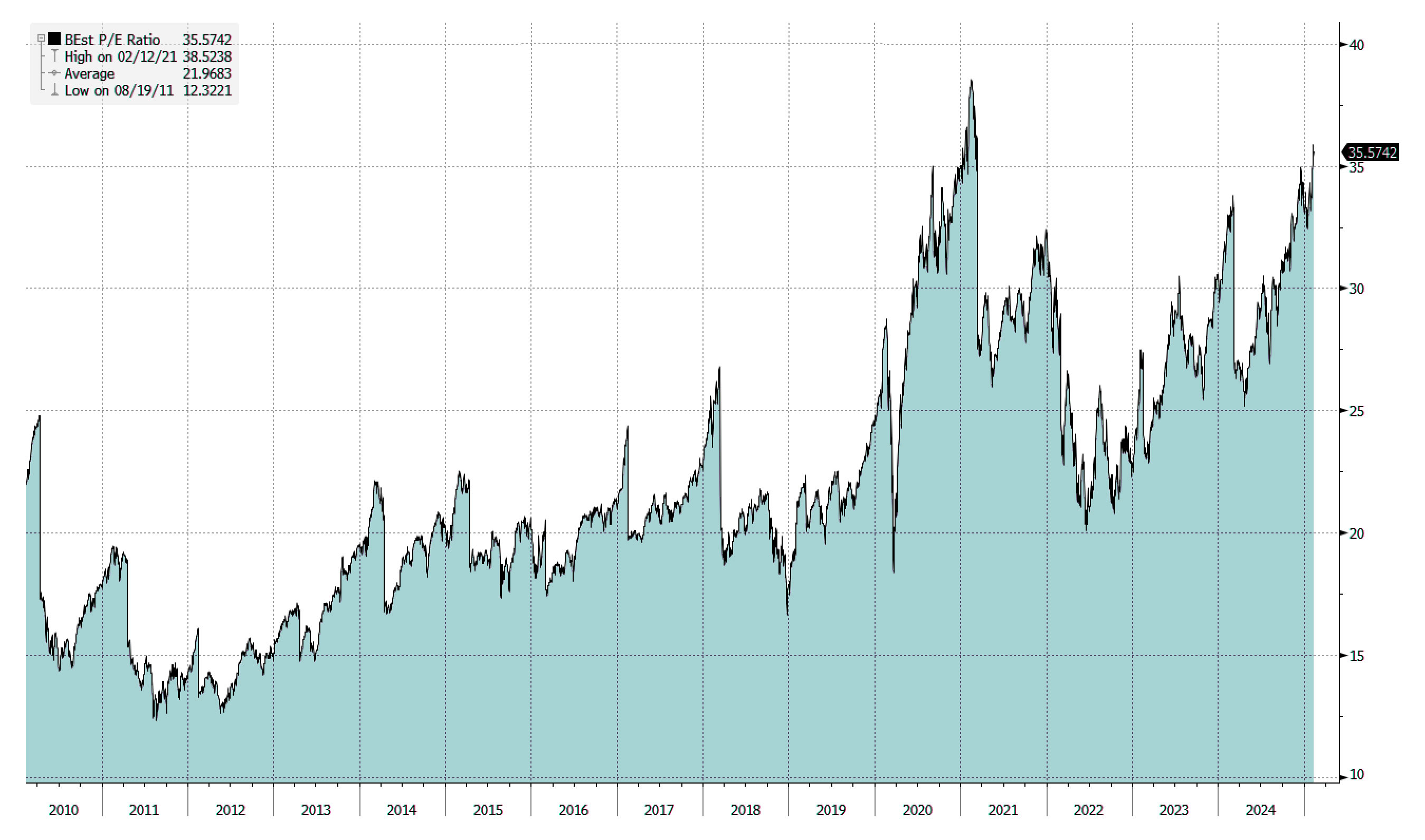

NOSEBLEED VALUATIONS

Chart: NDX valuation relative to 20year history

At 35 times earnings multiple, the tech heavy Nasdaq index is in its 99th percentile of valuations. Nvidia is even more exaggerated, at a valuation of circa 3.5trn USD, which would require sales growth of somewhere in the order of 30% for the next 8 years at current margins and maintaining its current free cash flow yield to justify it. It is at these types of stratospheric valuations, that investors when forced to quickly re-evaluate their understanding of a given franchise’s durability, can exit quickly enough to precipitate a 6% intra-day fall, just as we have seen in one trading session. The Nasdaq will likely quickly regain its footing, but it is often said that it is never the snake that you see that bites you and in this new Serpentine Chinese Lunar Year investors may do well to shift their attention (and capital) from the Bay Area of San Francisco to that of Shenzen’s.